At the end of 2015 there were $2.9 trillion in assets managed by hedge funds globally. Of that total, still less than one third of those assets are deployed into quantitatively driven strategies. Over the next 5 years we believe that ratio will reverse. In order to keep up, alternative asset managers will be required to completely reengineer their business model around technology and data science.

The quantitative tools and techniques to ingest and analysis massive data and then apply what we learn to successful investment strategies will become a necessary task. The lines between discretionary and quantitative will blur. At ARC we believe the future is a hybrid model that combines domain experts with a best-in-class suite of data analytics and AI tools that will outperform strategies run by either machines or humans alone.

Close

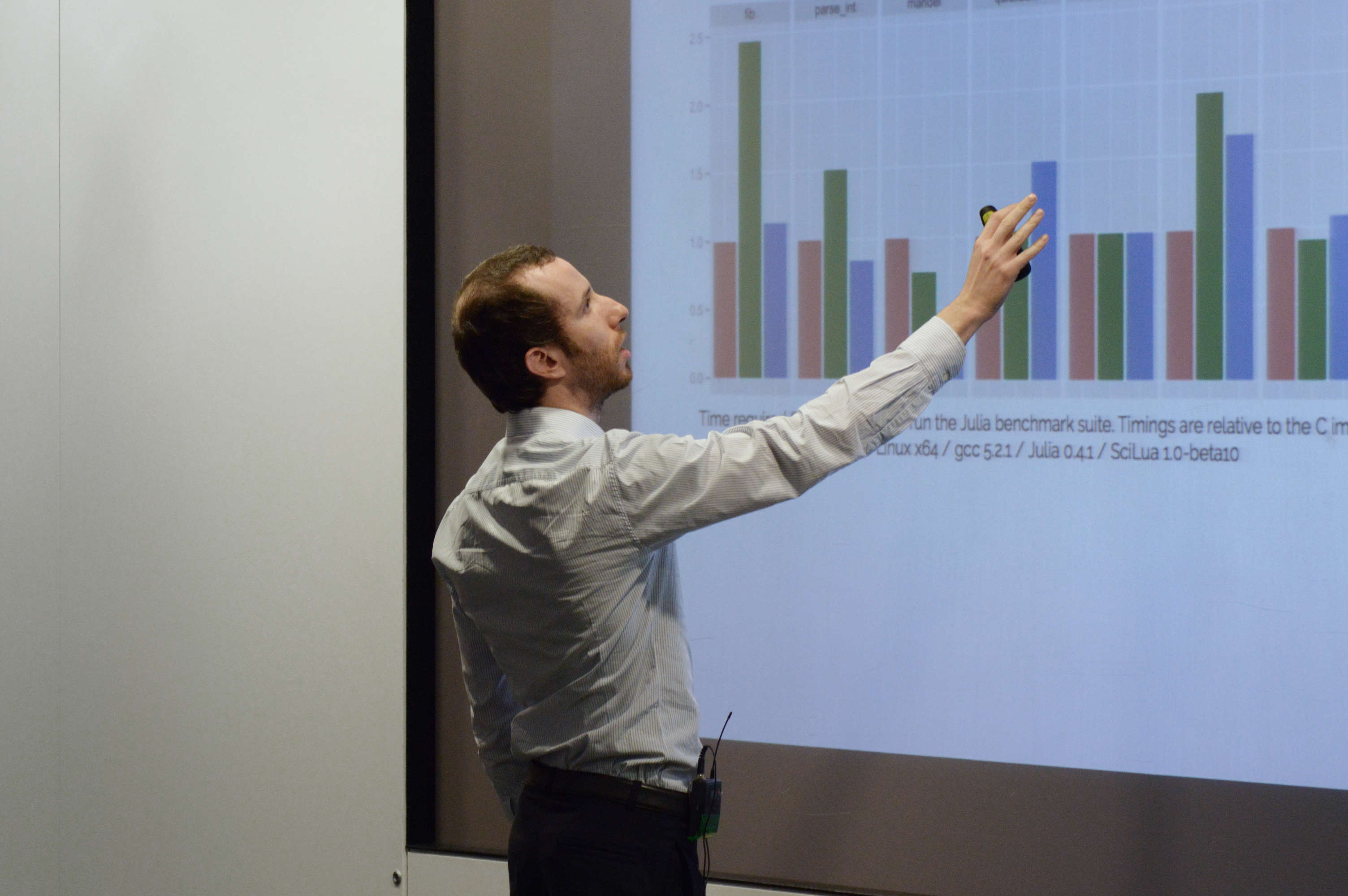

Deep learning has recently gained considerable attention in the fields of speech transcription and image recognition for their superior predictive properties. Due to the chaotic behavior of financial markets, one of the greatest challenges of today's financial research is to accurately predict the future market prices of stocks, currencies and commodities.

Yam will share some of his company trading experience using deep learning systems from the past couple of years and will present a fully working algorithm for automated intra-day trading.

Close

Cryptocurrencies and blockchain technologies are currently experiencing tremendous interest in the financial industry. This brief talk illustrates some fundamental, technical topics with pure Python.

Close

Starting from the observation that increments of the log-realized-volatility possess a remarkably simple scaling property, we show that log-volatility behaves essentially as a fractional Brownian motion with Hurst exponent H of order 0.1, at any reasonable time scale. The resulting Rough Fractional Stochastic Volatility (RFSV) model is remarkably consistent with financial time series data. We then show how the RFSV model can be used to price claims on both the underlying and integrated volatility. We analyze in detail a simple case of this model, the rBergomi model. In particular, we find that the rBergomi model fits the SPX volatility markedly better than conventional Markovian stochastic volatility models, and with fewer parameters. Finally, we show that actual SPX variance swap curves seem to be consistent with model forecasts, with particular dramatic examples from the weekend of the collapse of Lehman Brothers and the Flash Crash.

This is joint work with Andrew Lesniewski, Christian Bayer, Peter Friz, Thibault Jaisson, and Mathieu Rosenbaum.

Close

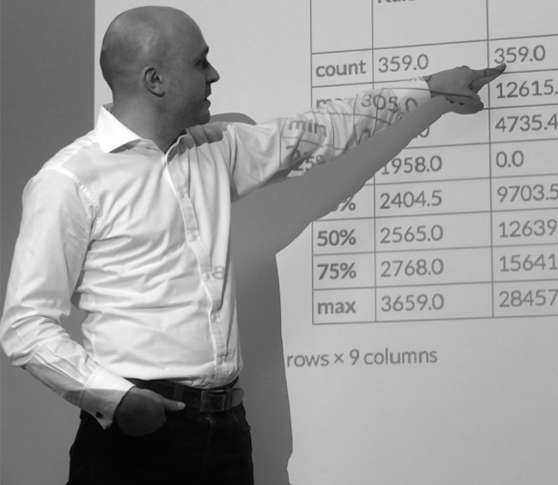

Jeff discusses and illustrates some useful tips and techniques in pandas. He will be addressing topics such as these:

- How to optimize performance.

- Do's and Don'ts when writing code.

- How to reduce memory usage in memory and permanent storage.

- Understanding Groupby Idioms.

- Using Categoricals.

- Working with MultiIndex Slicing.

- Understanding pandonic idioms and the pandas architecture.

Close

The high interconnectedness of the financial system poses problems that network models are meant to address. Following an introduction on networks, topological data analysis, centrality, and community structure, we'll take a look at concrete examples in the quest for e.g. diversification. Pandas, NetworkX, Bokeh provide a quick and pleasant way to implement and visually inspect them.

Close

xlwings has matured substantially since its first release 2 years ago and now offers to write Excel automation scripts, macros and user defined functions with Python instead of VBA. This talk gives a rundown of what xlwings can offer and how it can greatly enhance efficiency of financial analysts by integrating Excel with NumPy, pandas, matplotlib etc.

Close

Machine learning is an incredibly popular field that has been gaining steam over the last 10 years. As with any new technology, it has been eagerly thrown at many applications, including finance. Statistics gives us tools to analyze which uses of machine learning make sense and which do not, and we will discuss that in the context of writing trading algorithms that use machine learning.

Close

The Python/PyData ecosystem is still growing fast. This talk illustrates some recent valuable additions which are useful for Python. Among others, the talk briefly illustrates, respectively, use cases of blaze (data blending), TsTables (high performance tick data storage), xarray (n-dimensional variance of pandas data strucutres), Thomson Reuters Python-API and more.

Close

Quandl's mission is to democratize data. Quandl currently unifies over 20 million financial and economic datasets from over 500 publishers on a single user-friendly platform. Over the last two years Quandl has evolved its Python module to make it easier than ever to access all datasets directly through Python. During this talk, we will demonstrate how to make data calls, how to apply filters, and how to merge time series using Quandl's Python module. Additionally, we will demonstrate accessing non-time series data through the use of our new datatables structure.

Close

Traditionally, commodities futures models incorporate metrics like inventory numbers and supply demand numbers. While supply chain disruptions, outages and other significant events play a crucial role in the spot and futures prices, modeling them, however, is not trivial. In this talk, Sameena will speak about how her team captured significant events from news and modeled their impact on oil futures returns.

Close

Conference Schedule

for the Conference on 06. May 2016

Expert know-how you can immediately apply.